As Malaysia moves towards making e-invoicing mandatory by July 2025, many business owners are beginning to feel the pressure. This transition comes with its share of challenges, and for small businesses, it’s not just about meeting compliance – it’s about navigating new processes that can add strain to daily operations.

From training staff to ensuring accurate records, e-invoicing can be complex, especially for businesses dealing with high turnover. Training each new hire on the invoicing process takes time and money, and with manual tracking, the risk of human error increases. Small mistakes can lead to compliance issues, and as invoice volumes grow, maintaining accurate records without errors becomes even more crucial. For many business owners, this means a greater investment of both time and money.

To make this transition smoother, here’s a breakdown of steps to help you save time, reduce errors, and stay compliant with e-invoicing requirements.

1. Understand the basics of e-invoicing

Malaysia’s Inland Revenue Board (LHDN) now requires businesses to use e-invoicing, which can feel overwhelming for those new to digital systems. E-invoices must be submitted in XML, JSON, or PDF formats, but even choosing the right file type can be tricky if you’re unfamiliar with digital conversions.

Another challenge is the need to fill in up to 55 fields per invoice, covering details like transaction info, customer details, and item descriptions. For small businesses with limited staff, this process is time-consuming and leaves room for errors, which could lead to costly corrections or even penalties.

Manually entering this data also takes time, pulling staff away from other tasks and causing delays. That’s why understanding these requirements upfront and finding ways to simplify the process are key to making e-invoicing smoother and more manageable.

This is why understanding these requirements upfront and finding ways to streamline the process will be key to making this transition as smooth as possible.

| 💡 Tip: Identify the mandatory fields that apply to your transactions specifically, so you don’t waste time on unnecessary details. |

2. Decide between manual or automated submissions

When it comes to e-invoicing, Malaysian businesses have two main submission options: manual entry via LHDN’s MyInvois Portal or automated submission through API integration.

- Manual Submission via MyInvois Portal: This option is free but requires manual data entry for every invoice, which can be time-consuming for high-volume F&B and retail businesses. Imagine filling out details for every order – it quickly becomes overwhelming.

- Automated Submission via API: With automation, submission becomes almost instant. This requires accounting or POS software that can integrate with LHDN’s system, often involving an upfront cost. However, for businesses with a high invoice volume, the efficiency and error reduction offered by automation often make it worth the investment.

| 💡 Tip: Start by identifying which fields and formats apply to your business type to avoid unnecessary complications later. |

3. Choose the right POS or accounting software

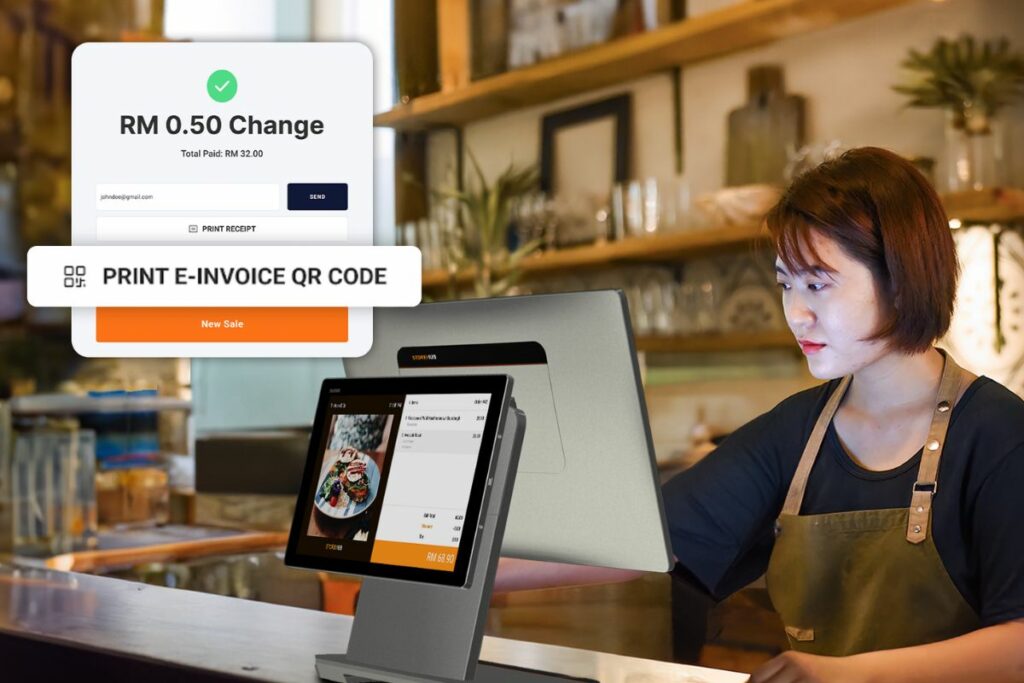

Choosing the right software for e-invoicing is essential. Look for a system that integrates directly with LHDN for quick, error-free invoicing. Automated systems like StoreHub work seamlessly with LHDN, eliminating the need for manual compliance checks.

To get started, simply appoint StoreHub as your e-invoicing intermediary on the MyTax website – this keeps the process simple and fully compliant.

StoreHub also integrates with popular accounting platforms like QBO, Financio, and SQL, letting you manage invoicing and finances from one central system.

Here’s what to prioritise when choosing your e-invoicing software:

- Easy Integration: Choose a POS or accounting system that connects directly to LHDN’s system, like StoreHub, for smooth, hassle-free submissions.

- Accuracy and Efficiency: Automated software minimises invoicing errors, allowing your team to focus on customer service instead of double-checking entries.

| 💡 Tip: With a POS system like StoreHub, you only need to set up e-invoicing once. From there, it runs automatically, managing each transaction effortlessly and even taking care of monthly submissions to LHDN for you. |

4. Ensure that your team is well-trained

Shifting to e-invoicing can feel like a big adjustment, especially for businesses where employees are less familiar with digital systems or where high staff turnover is common. Training each new employee to handle manual submissions can quickly become a time-consuming task. Not only do these training sessions pull staff away from other essential duties, but the manual entry process itself can be tedious, often leading to mistakes. These errors, even if small, can cause compliance issues and require further correction – meaning more time and resources spent.

Automated systems like StoreHub simplify this by allowing employees to manage e-invoices with just a single click. This automation dramatically reduces the need for long training sessions and ensures new staff can be brought up to speed quickly, without interrupting operations.

By handling complex tasks in the background, automation minimises errors, keeps processes efficient, and helps your team focus on serving customers instead of trying to keep up with invoice compliance.

| 💡 Tip: Using an automated, all-in-one system like StoreHub means that your staff will not need to memorise every detail of the MyInvois Portal – they just need to know how to use your POS system. |

5. Prepare ahead of time

It’s best not to wait until the last minute to prepare for e-invoicing. By starting your transition now, you give yourself ample time to understand the system, identify and resolve any potential issues, and ensure your business is fully compliant well before the July 2025 deadline. Getting a head start means you won’t have to scramble or risk penalties due to unforeseen challenges.

Begin by familiarising yourself with LHDN’s guidelines and carefully reviewing software options that best suit your business needs. This preparation includes assessing whether you’ll opt for manual entry through the MyInvois Portal or automated solutions, which can save significant time and reduce errors. Additionally, starting early allows you to train your team gradually, reducing stress and ensuring everyone is comfortable with the new system before it becomes a requirement.

| 💡 Tip: Think of e-invoicing as an opportunity to streamline your operations and grow your business. With an automated system, you’ll be ready for compliance and can save time every day on administrative tasks. |

Conclusion

Switching to e-invoicing might feel overwhelming, but with the right tools and a clear plan, it doesn’t have to be. By following these steps and considering automated solutions, you can cut down on manual work, reduce errors, and make the transition as smooth as possible.

An automated POS system like StoreHub helps you stay compliant, save time, and keep things running efficiently – and it comes at no extra cost.

Unlike other accounting software that often charges additional fees for API integration, StoreHub includes this feature in its standard plan, giving you seamless access to LHDN’s e-invoicing system without hidden charges.