The All-In-One Platform for Your Restaurant or Retail Store

Digitise your operations and automate your business easily and simply with StoreHub

Trusted by 15,000+ F&B and retail businesses across Southeast Asia

Easy-to-use and set up

User-friendly interface you can get started with minimal training.

Cloud-based operating system

Manage your business remotely. Run multiple stores from your phone.

Process transactions faster

Help your staff spend more time focusing on your customers (and less time staring at the POS).

Expert advice and support

From specialised customer care agents to WiFi network pros – we’re here to support you every day.

More than just a POS System

- Point of Sale

- Cashback Loyalty

- QR Order & Pay

- Automated Customer Engagement

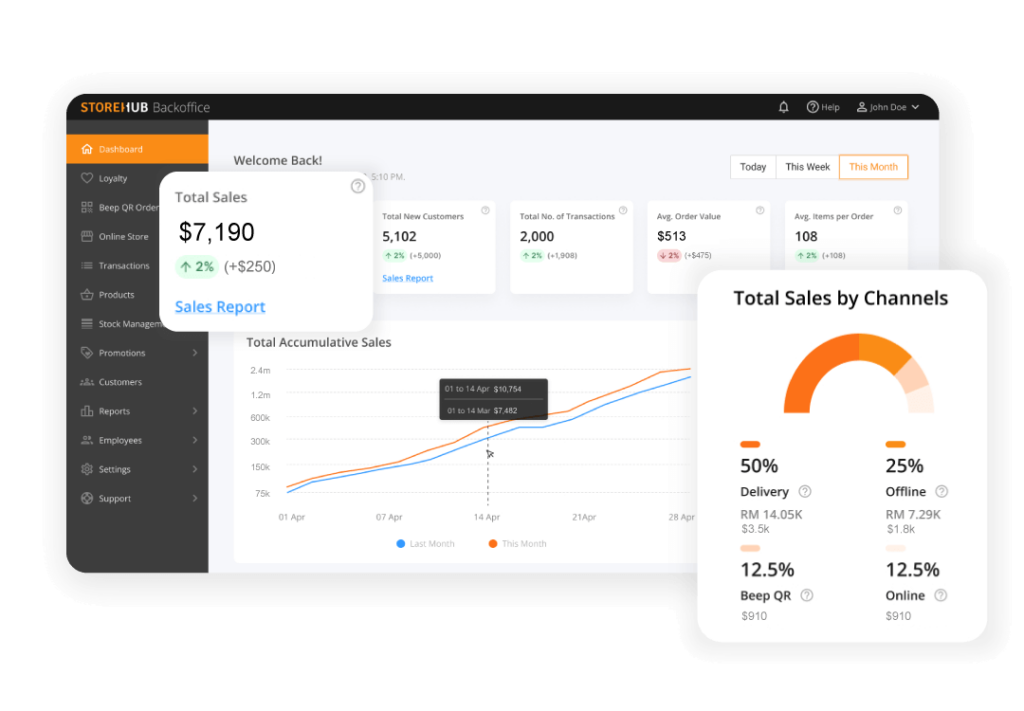

- Reporting & Analytics

- Online Ordering

Manage all online & offline transactions in one system

You’ve got nothing to worry about with StoreHub’s top-of-the-line POS hardware, integrated payments, and no-training-required user interface.

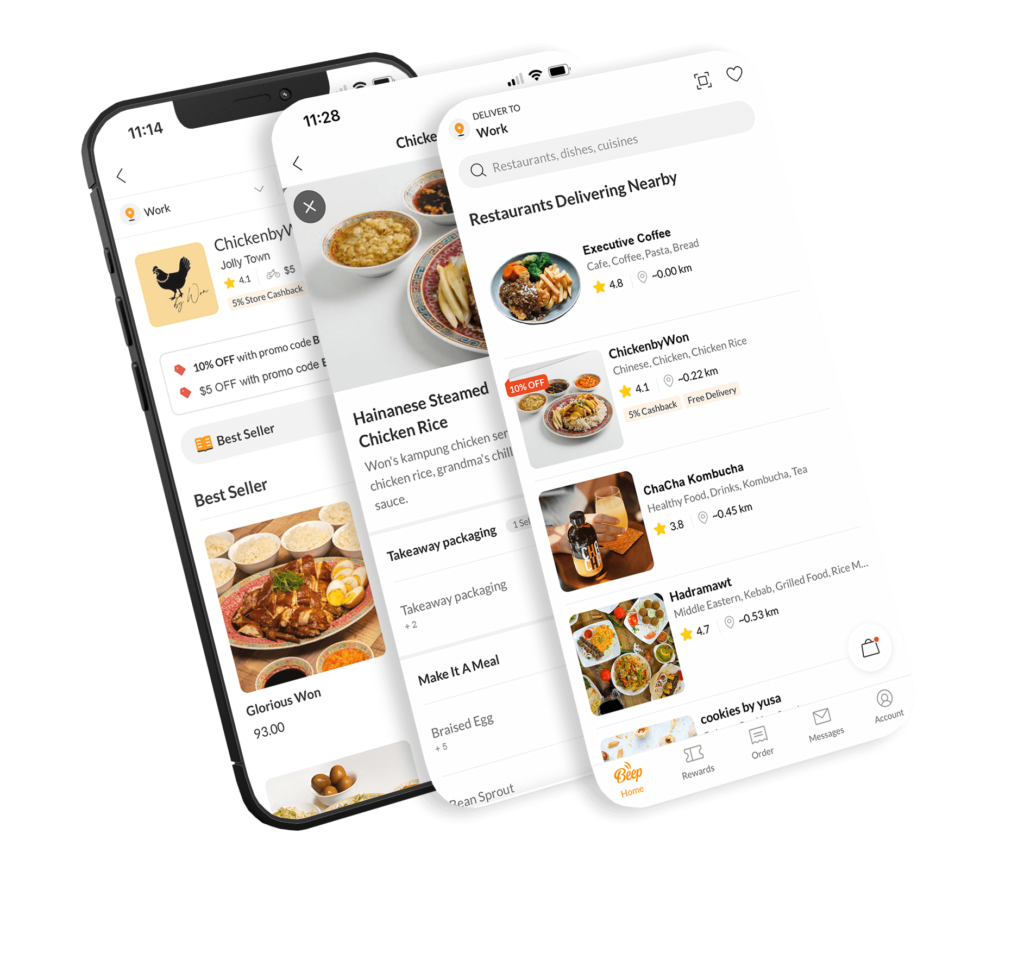

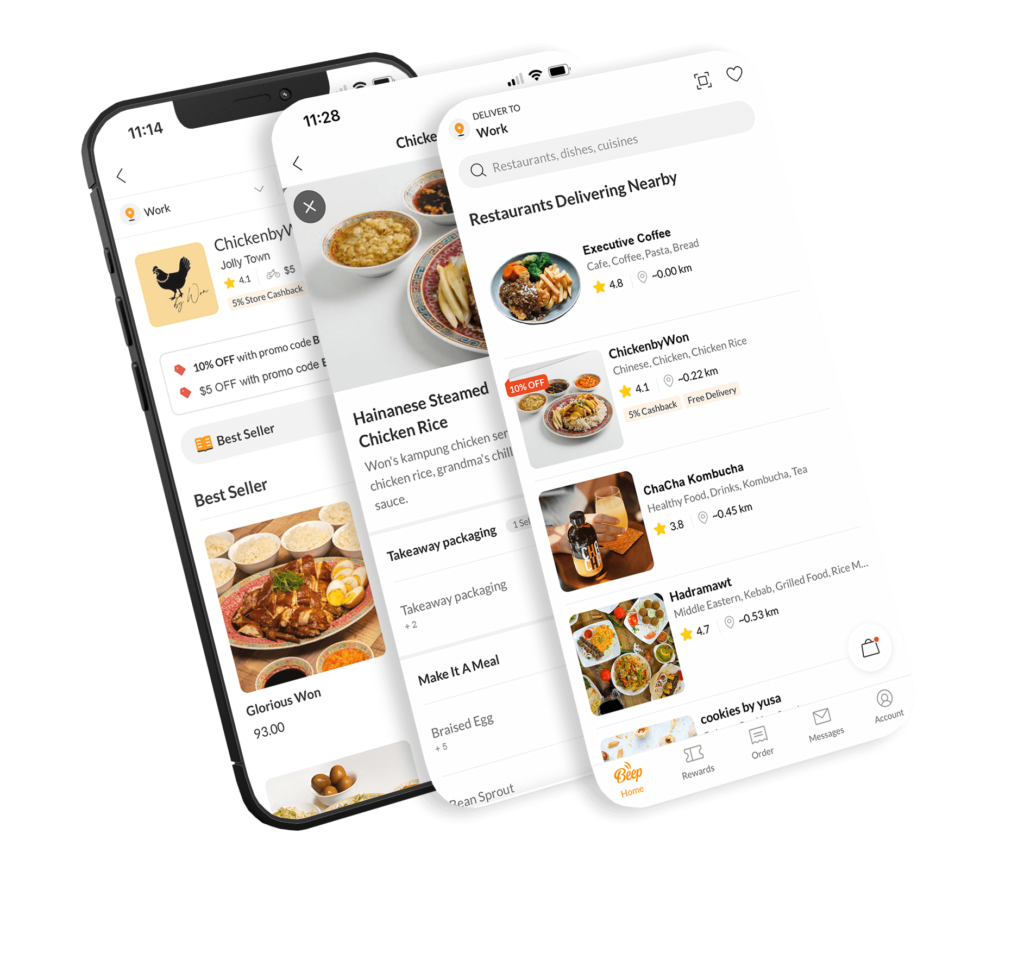

Run your own cashback loyalty programme

A fully-automated way to collect customer data & drive repeat purchases online and in-store.

Enable faster and better service

Increase table turnover while cutting labour costs.

Increase transactions by up to 80%.

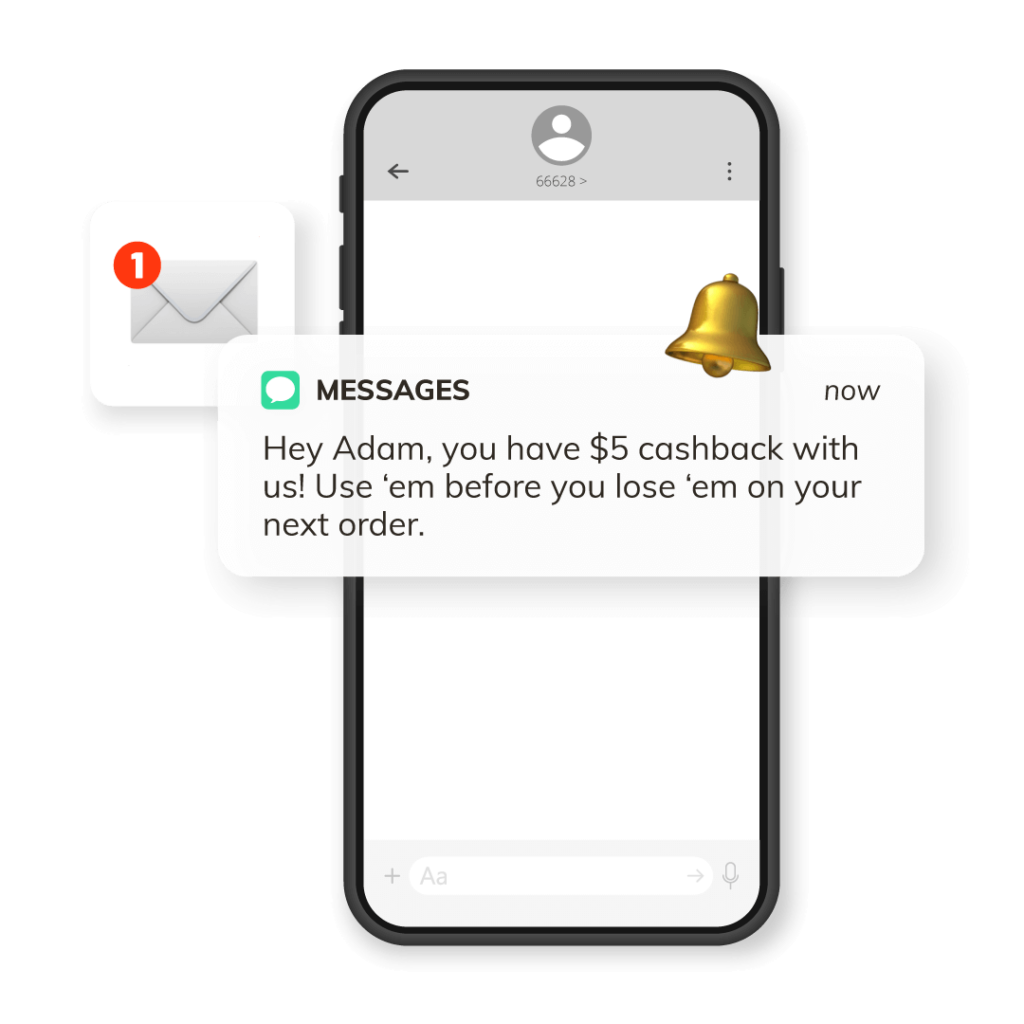

Bring customers back – automatically

Set up automatic SMS marketing campaigns to boost sales and drive repeat visits.

Generate up to 25X ROI for each campaign.

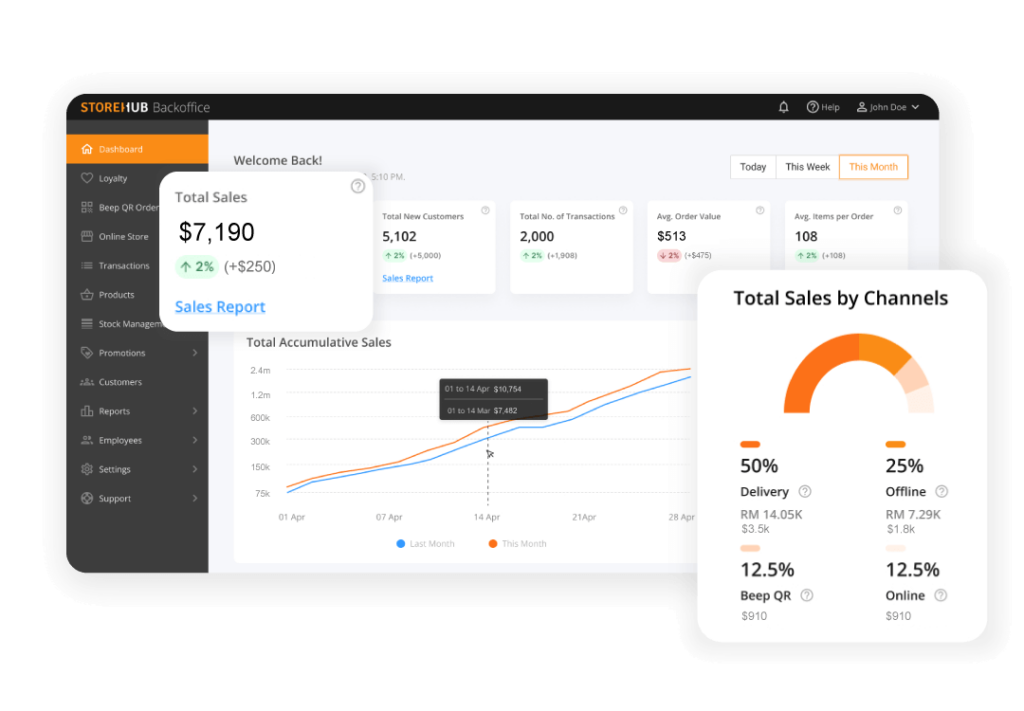

Make smarter business decisions with data-driven insights

Identify bestsellers and peak hours.

Get insights on staff performance, inventory, and more.

Run your own food delivery service

Enable your own pickup & delivery service while collecting customer data, maintaining margins, and saving on commissions.

Manage all online & offline transactions in one system

You've got nothing to worry about with StoreHub's top-of-the-line POS hardware, integrated payments, and no-training-required user interface.

Run your own food delivery service

Enable your own pickup & delivery service while collecting customer data, maintaining margins, and saving on commissions.

Enable faster and better service

Increase table turnover while cutting labour costs.

Increase transactions by up to 80%.

Run your own cashback loyalty programme

A fully-automated way to collect customer data & drive repeat purchases online and in-store.

Make smarter business decisions with data-driven insights

Identify bestsellers and peak hours.

Get insights on staff performance, inventory, and more.

End-to-end support committed to help you succeed

One-on-one onboarding. Webinars, demos and videos. Unlimited support available on Live Chat, email and phone 7 days a week.

Join successful entrepreneurs already on the StoreHub ecosystem

“What we’ve come to realise is that people are more receptive to placing their second or third orders after their meals, so it has contributed quite a significant bit to our sales!”

Datin Christine

Co-founder of Pokok KL

"If not for StoreHub's Online Order & Delivery that has helped us generate a significant amount of traffic for the restaurant and allowed me to reach my customers out of Kuala Lumpur, it would’ve been lights out already and that’s the truth."

Mervyn Lee

Co-Owner of Yut Kee Restaurant

"Now with StoreHub, we can manage our business anytime, anywhere.

As long as you have a phone and internet connection, you can manage and view sales for any particular day, at any outlet."

Ezzad Emir

Co-Founder of Quackteow

Take the first step in enabling operational excellence for your business.